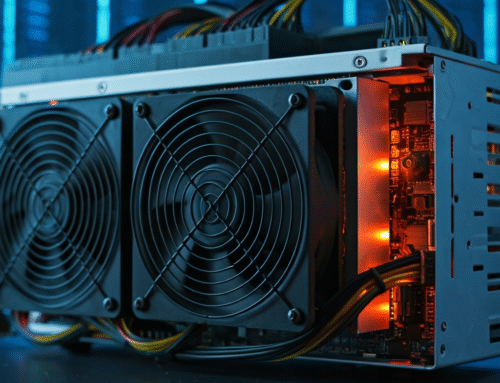

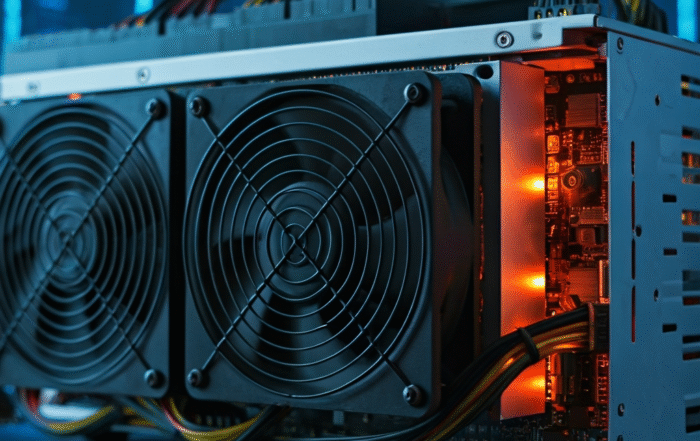

Riot Platforms, one of North America’s largest Bitcoin mining companies, has unveiled a significant investment in its operational infrastructure, confirming the purchase of new, state-of-the-art Application-Specific Integrated Circuit (ASIC) miners. The deal underscores a critical trend in the crypto mining industry as companies adapt to the new economic realities following the April 2024 Bitcoin halving.

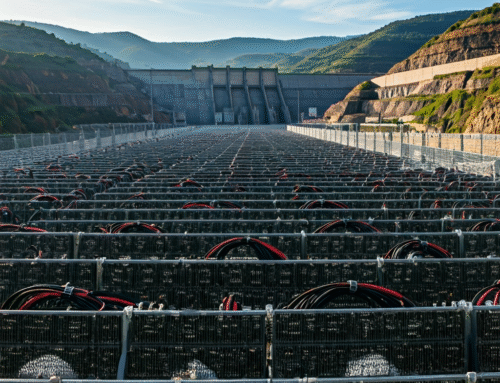

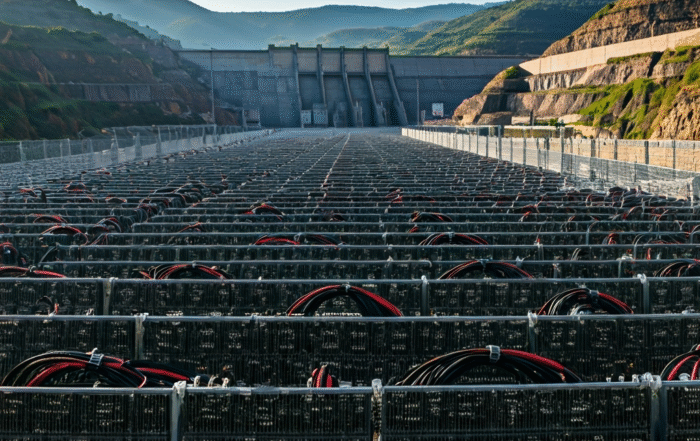

The acquisition focuses on securing the latest generation of hardware, which offers substantial improvements in energy efficiency and hashing power. This strategic fleet upgrade is designed to lower Riot’s average cost of mining a single Bitcoin, a crucial metric now that block rewards have been cut in half. By deploying more powerful and less energy-intensive machines, the company aims to maximize its profit margins and strengthen its competitive position against other industrial-scale miners.

Industry analysts view this move as a strong, bullish signal for the mining sector. It demonstrates that well-capitalized firms are confident in the long-term profitability of Bitcoin and are willing to invest heavily to maintain their dominance. This multi-million-dollar investment is part of an industry-wide “efficiency arms race,” where miners with older, less efficient hardware risk being priced out of the market. The pressure to upgrade is driving significant demand for new mining rigs from leading manufacturers.

For companies like Endemine.com, which specialize in crypto mining hardware, this trend represents a significant market opportunity. Riot’s large-scale purchase highlights the necessity for all miners, from hobbyists to enterprises, to continuously evaluate and upgrade their equipment to stay profitable in an increasingly competitive landscape.

Leave A Comment