The Bitcoin mining sector is currently the stage for a significant corporate clash, as Bitfarms has initiated a strategic defense to protect itself from a hostile takeover. The company’s board of directors has unanimously approved a shareholder rights plan, colloquially known as a “poison pill,” in direct response to an acquisition attempt by fellow mining giant Riot Platforms.

This defensive maneuver was triggered after Riot Platforms recently acquired a 9.25% stake in Bitfarms and subsequently proposed to acquire all outstanding shares. The “poison pill” is designed to prevent a creeping takeover by making it prohibitively expensive. The plan activates if any entity accumulates a 15% or greater stake in the company without the board’s approval. Should this threshold be crossed, the plan allows existing shareholders (excluding the acquirer) to purchase additional shares at a significant discount, thereby diluting the hostile bidder’s stake and increasing the cost of the acquisition.

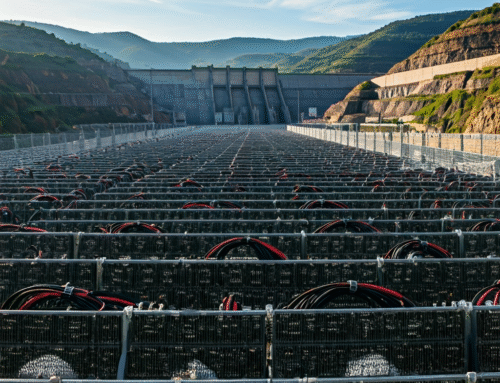

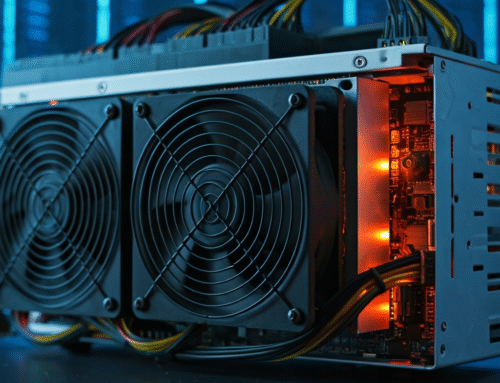

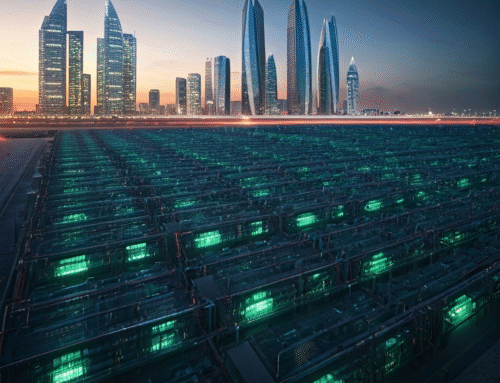

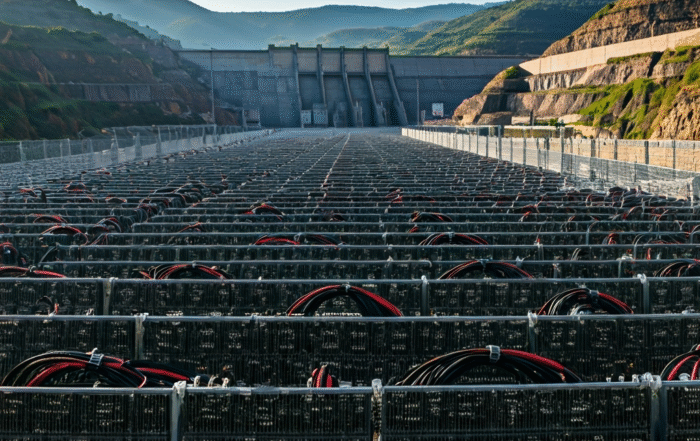

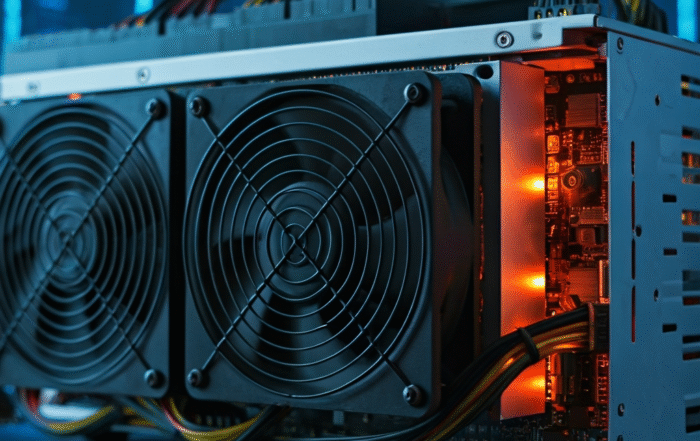

This development underscores a period of aggressive consolidation within the crypto mining industry. As the sector matures, particularly in the wake of the recent Bitcoin halving, larger players are looking to absorb competitors to gain market share, enhance operational efficiency, and control a larger portion of the global hashrate. The value of established mining infrastructure, including state-of-the-art facilities and large fleets of ASIC miners, is at an all-time high.

For the broader market, this high-stakes battle between two of the industry’s most prominent names signals strong confidence in the long-term profitability of Bitcoin mining. The fierce competition to acquire established operations points to a bullish outlook on the value of cryptocurrency assets and the infrastructure required to secure them, driving continued demand for powerful and efficient mining hardware.

Leave A Comment