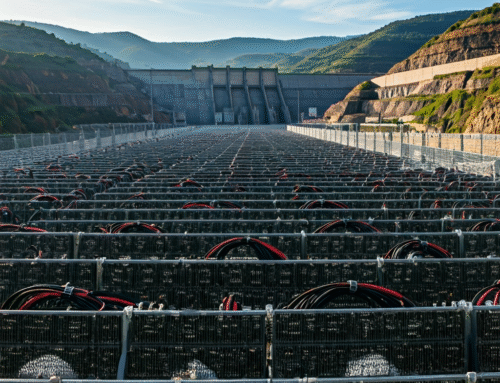

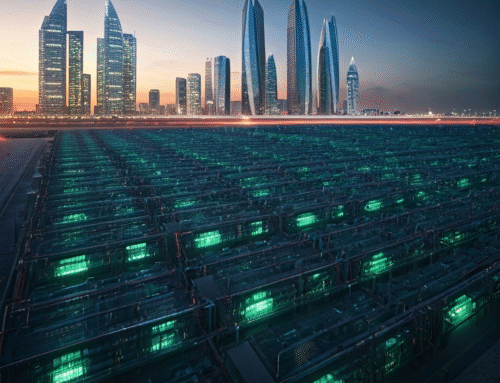

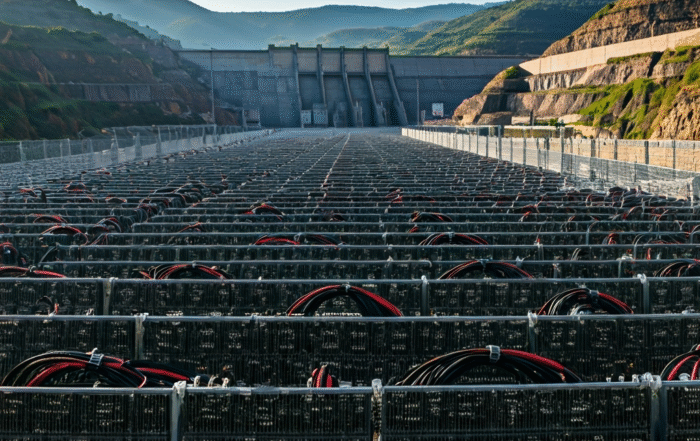

The Bitcoin network has just undergone a notable downward difficulty adjustment, offering a slight reprieve to miners in an increasingly competitive landscape. This automatic recalibration, which occurs approximately every two weeks, has made it temporarily easier to mine a Bitcoin block, directly boosting the profitability of active mining operations globally. The adjustment comes as the network’s total hashrate, a measure of the total computational power dedicated to mining, has stabilized after periods of intense growth.

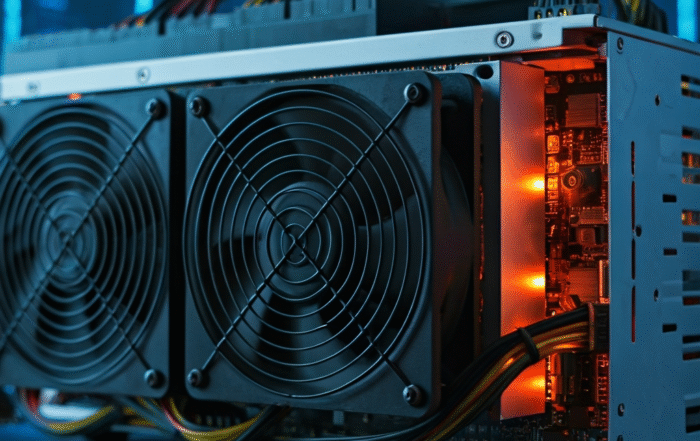

For crypto mining hardware sellers like Endemine.com, this development underscores a crucial dynamic in the market. While a difficulty drop provides a short-term revenue increase for miners using existing equipment, it also shines a spotlight on the relentless need for efficiency. The miners who benefit most from these conditions are those operating the latest generation of ASIC machines, which offer a superior hash-per-watt output. As profitability margins are directly tied to operational costs, primarily electricity, hardware that minimizes energy consumption per terahash (J/TH) remains the key to long-term success.

This adjustment serves as a reminder that the mining industry is a constant race for technological superiority. Following the recent Bitcoin halving, which cut block rewards in half, efficiency is no longer just an advantage—it is a requirement for survival. Operators who fail to upgrade their fleets risk being priced out of the market as the global hashrate inevitably climbs and difficulty follows suit. The current ease in difficulty is best seen not as a new status quo, but as a strategic window for miners to reinvest profits into upgrading their infrastructure to prepare for the next wave of competition.

Leave A Comment