Bitcoin mining heavyweight Core Scientific announced it has rejected an unsolicited, all-cash buyout proposal from AI cloud provider CoreWeave valued at approximately $1.02 billion. The offer, which proposed $5.75 per share, was unanimously declined by Core Scientific’s board, which determined that the offer undervalues the company and is not in the best interests of its shareholders.

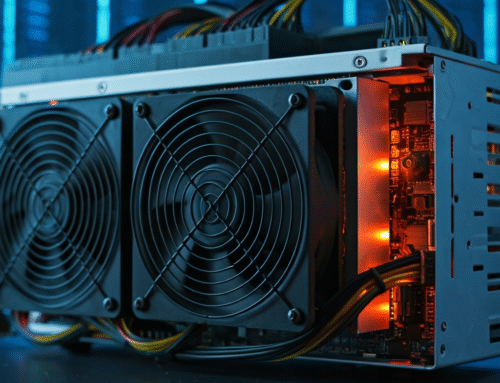

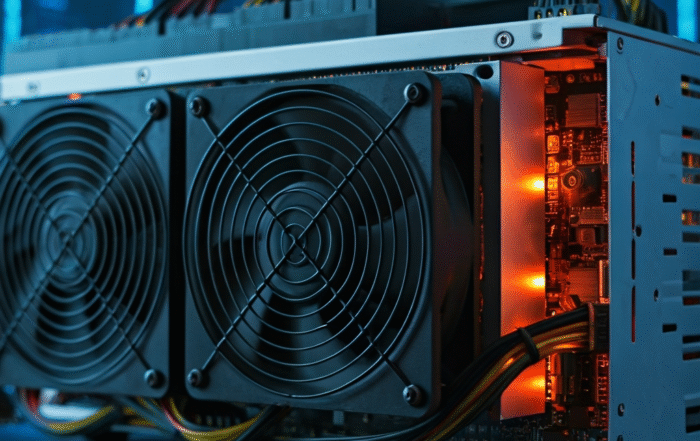

This development is highly significant as it highlights the rapidly growing convergence of the artificial intelligence and cryptocurrency mining industries. CoreWeave, a specialized cloud provider backed by tech giants like Nvidia, is aggressively expanding its capacity to meet the immense demand for AI and high-performance computing (HPC). Its bid for Core Scientific was a clear strategic move to acquire the miner’s extensive data center infrastructure and high-capacity power agreements—assets that are increasingly scarce and valuable in the current tech landscape.

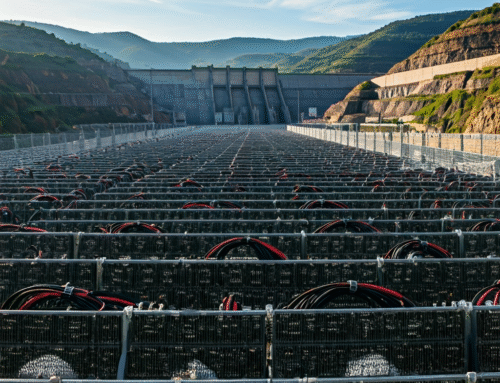

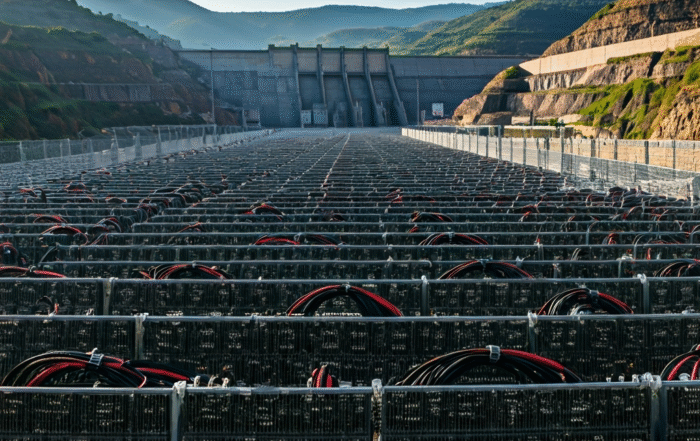

While the full acquisition was rejected, the two companies are moving forward as partners. Just before the buyout offer became public, Core Scientific had signed a massive multi-year deal to provide CoreWeave with up to 200 megawatts (MW) of power and infrastructure for its HPC operations. This existing partnership underscores the strategic value of mining facilities beyond their use in minting digital currencies.

The board’s rejection signals strong confidence in Core Scientific’s standalone future, which involves a dual strategy of continuing its Bitcoin mining operations while simultaneously leasing its valuable infrastructure to AI clients. For the broader crypto mining industry, this event is a powerful validation. It demonstrates that the physical assets and power capabilities built for mining are now highly sought-after by the booming AI sector, suggesting a robust and diversified future for infrastructure-focused mining companies and increasing the intrinsic value of their hardware assets.

Leave A Comment