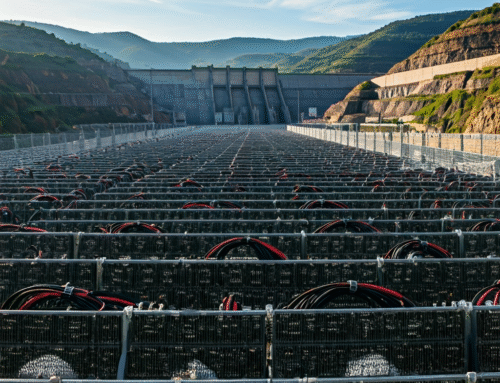

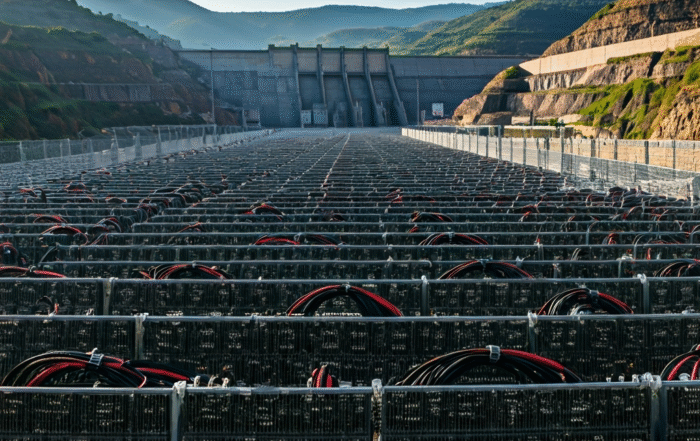

In the weeks following the highly anticipated fourth Bitcoin halving in April 2024, the network’s hashrate has demonstrated remarkable resilience, defying predictions of a sustained downturn. After an initial, expected dip as less efficient operations powered down, the network’s total computational power has stabilized and begun to trend upwards again, signaling strong confidence among industrial-scale and professional miners.

The halving event cut the block reward for miners from 6.25 BTC to 3.125 BTC, effectively slashing a major revenue stream in half overnight. This economic shift was expected to force many miners with older-generation hardware offline, leading to a significant drop in the network hashrate. While a temporary decline did occur, the subsequent recovery highlights a key evolution in the mining industry: the critical importance of operational efficiency.

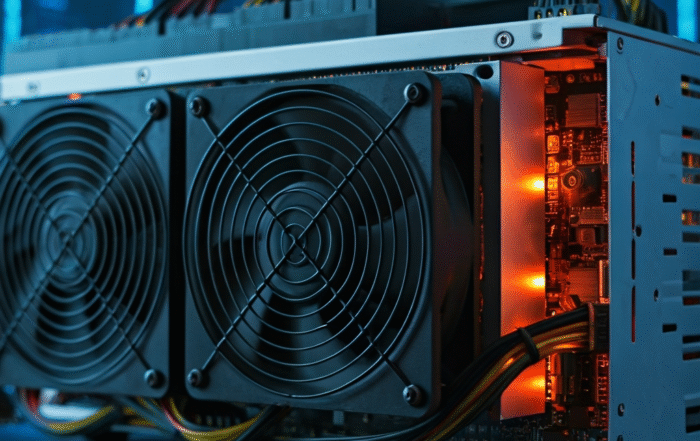

Analysts attribute this rapid rebound to two main factors. First, the industry has become dominated by well-capitalized operations that invested heavily in the latest generation of ASIC miners leading up to the halving. These machines, with their superior hash-per-watt performance, can remain profitable even with lower block rewards. This trend pushes the entire industry towards upgrading, as outdated hardware is no longer viable.

Second, transaction fees have provided a crucial, albeit volatile, supplementary income stream. The introduction of new protocols like Ordinals and Runes has, at times, caused transaction fees to spike, temporarily offsetting the reduced block rewards. Miners with the most efficient hardware are best positioned to capture this value. This post-halving environment underscores that long-term success in Bitcoin mining is now intrinsically linked to possessing the most advanced and energy-efficient equipment available, reinforcing the ongoing cycle of hardware innovation and investment.

Leave A Comment